san francisco gross receipts tax pay online

Enter your login information which was provided in letter you recently received from our office. During the phase-in period businesses will pay both a gross-receipts.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Learn about excise tax and how Avalara can help you manage it across multiple states.

. Ad Pay Your Taxes Bill Online with doxo. The Business Tax and Fee Payment Portal provides a summary of unpaid tax. Instructions for Reporting 2020 Gross Receipts Click here to begin.

Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Ad Apply For Tax Forgiveness and get help through the process.

The registration fee ranges from 17555 to 40959 based on payroll expense attributable to San Francisco. Hawaii and New Mexico are exceptions to the rule and tax a wide range of. San Francisco ABT 2021 2021 Annual Business Tax Returns To begin filing your 2021 Annual Business Tax Returns please enter.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. San Francisco Online Bill Payment 02142022 Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal. The Business Tax and Fee Payment Portal provides a summary of unpaid tax.

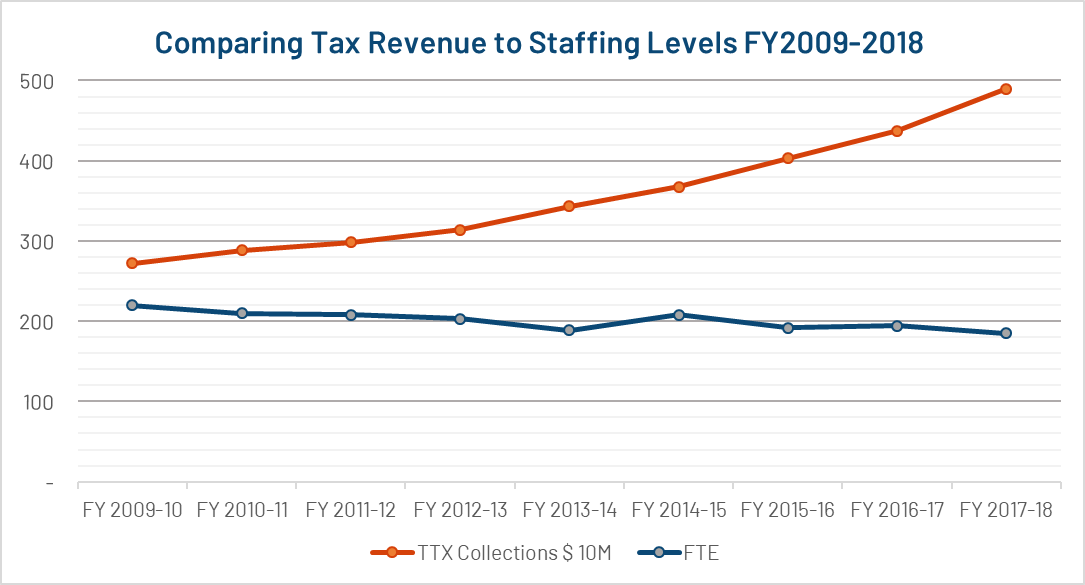

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Learn about excise tax and how Avalara can help you manage it across multiple states. Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax.

Final Payments for Q4 2014 The current due date for the. During the phase-in period businesses will pay both a gross-receipts. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal.

Ad Find out what excise tax applies to and how to manage compliance with Avalara. Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax. The applicable gross receipts tax rate depends on the business activity associated with the gross receipts earned.

Business Tax Payment Portal The quarterly estimated payment shown in our system is based on your 2021 Annual Business Tax Returns filing. Your seven 7 digit Business Account Number The last. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. FEB 2 SF Annual Gross Receipts Tax for 2020 filing payment deadline Gross Receipts tax rates in San Francisco. The tax rate for 2022 is 14.

And Brackets Sales Tax Rates COVID-19 Response Center Online Sales Taxes. Add additional city of operating in san francisco gross receipts tax payment for bad debts with the summary page. You may pay the lesser of the amount displayed.

For tax year 2017 the gross receipts tax rates range from 005625 to 04875. Retail and wholesale Code Sec 9531 Manufacturing transportation and warehousing. SFMTA Payment Plan Portal The San Francisco Municipal Transportation Agency SFMTA has partnered with the San Francisco Office of the Treasurer Tax Collector Bureau of Delinquent.

Calculations of 2022 estimated quarterly business tax payments will be based on the information entered in your San Francisco Annual Business Tax Return for 2021 and will be displayed in the. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. Proposition F eliminates the Citys Payroll Expense Tax and gradually raises.

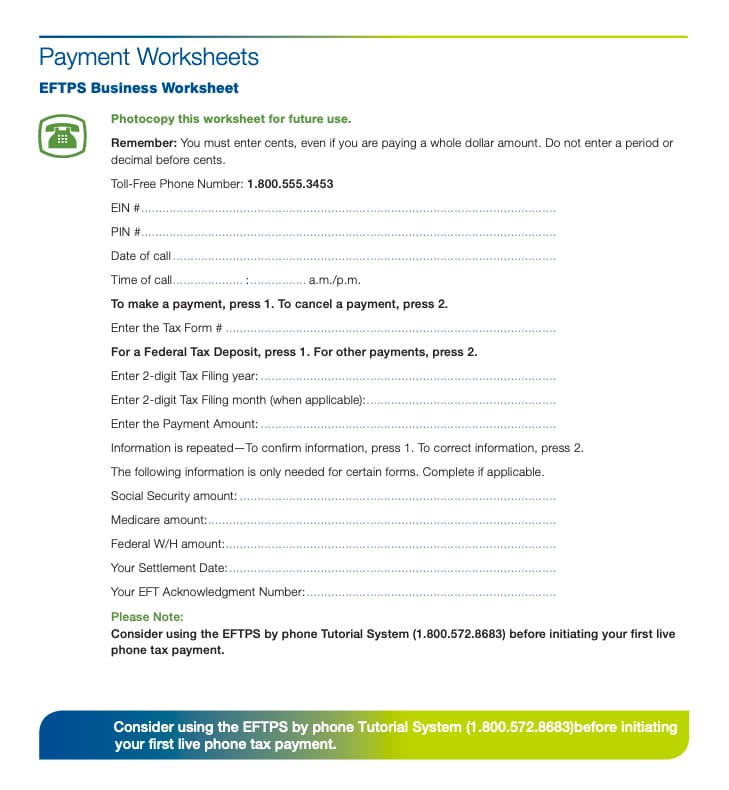

What Is Eftps An Employer S Guide To The Electronic Federal Tax Payment System

What Is Casdi Employer Guide To California State Disability Insurance Gusto

Taxes 2022 7 On Your Side United Way Answer Viewer Questions During Tax Chat Abc7 San Francisco

Property Taxes Lookup Alameda County S Official Website

What Is Gross Receipts Tax Overview States With Grt More

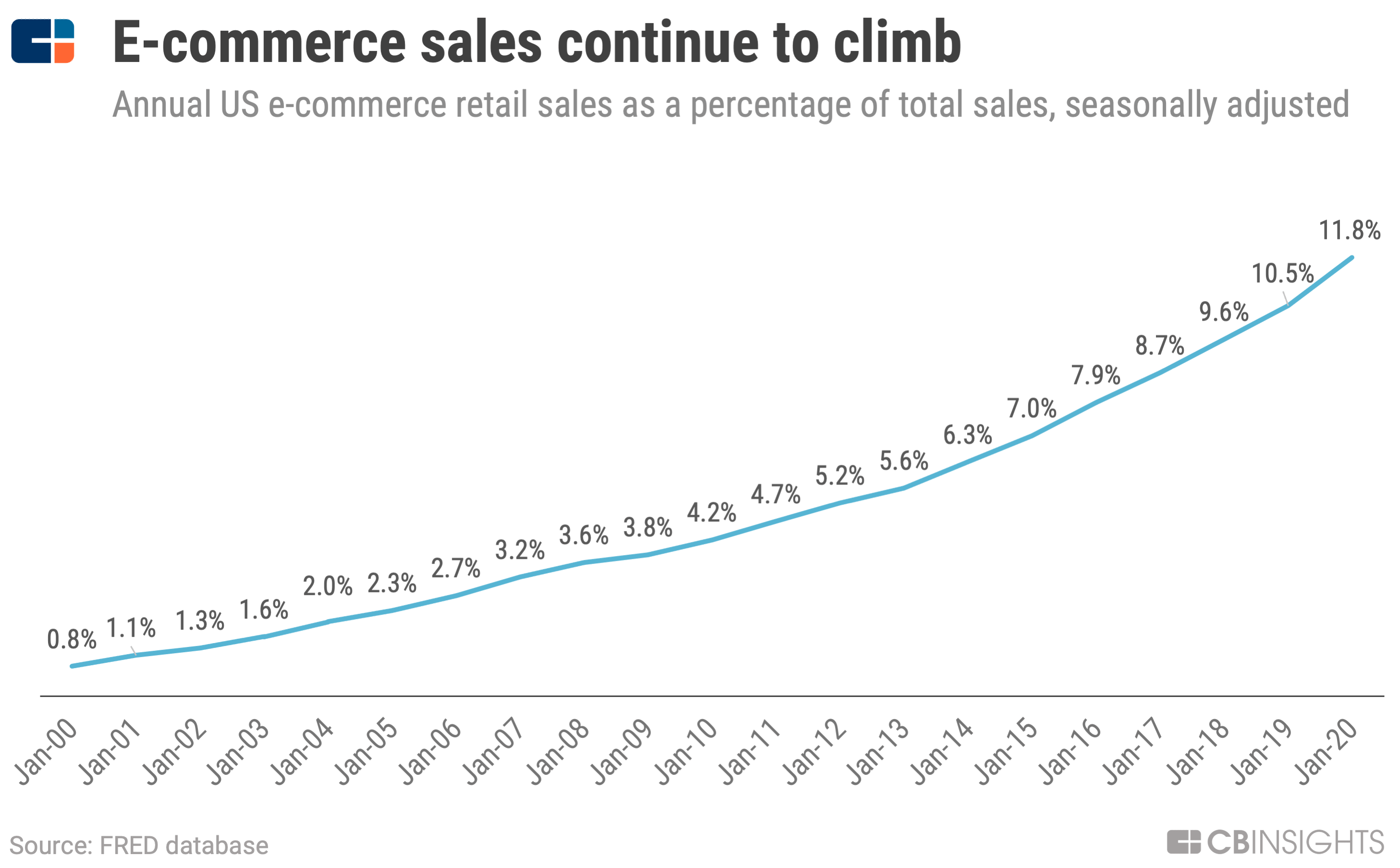

Stripe Teardown How The 36b Payments Company Is Supercharging Online Retail Cb Insights

Payroll Tax Vs Income Tax What S The Difference

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

Claiming Property Taxes On Your Tax Return Turbotax Tax Tips Videos

3 17 277 Electronic Payments Internal Revenue Service

Fillable Online Sftreasurer Paper Filing Mock Up Docx Sftreasurer Fax Email Print Pdffiller

Gross Receipts Taxes Are Making A Dangerous Comeback Tax Foundation

States Latest Weapon In The Struggle For Tax Revenue Gross Receipts Taxes Accounting Today

How Do State And Local Sales Taxes Work Tax Policy Center

2022 San Francisco Tax Deadlines

Different Types Of Payroll Deductions Gusto

Key Dates Deadlines Sf Business Portal